Comprehensive Review of Deriv Exchange: A Deep Dive Into a Leading Derivatives Trading Platform

When it comes to trading financial derivatives, selecting the right platform is crucial for success. Deriv Exchange, a popular platform offering various trading instruments like forex, commodities, cryptocurrencies, and synthetic indices, stands out in the crowded space of online trading platforms. In this review, we will explore the key features, benefits, and notable drawbacks of Deriv to provide a detailed and balanced perspective.

Overview of Deriv Exchange

Deriv Exchange was built on the foundation of Binary.com, a platform known for offering binary options trading. Over the years, Deriv has expanded its scope to include contracts for difference (CFDs), forex trading, multipliers, and synthetic indices. It is available on multiple platforms such as DTrader (for manual trading), DBot (an automated trading bot), and DMT5 (MetaTrader 5 for advanced traders). The wide variety of instruments and platforms make Deriv accessible to both beginners and experienced traders.

Key Features and Trading Resources

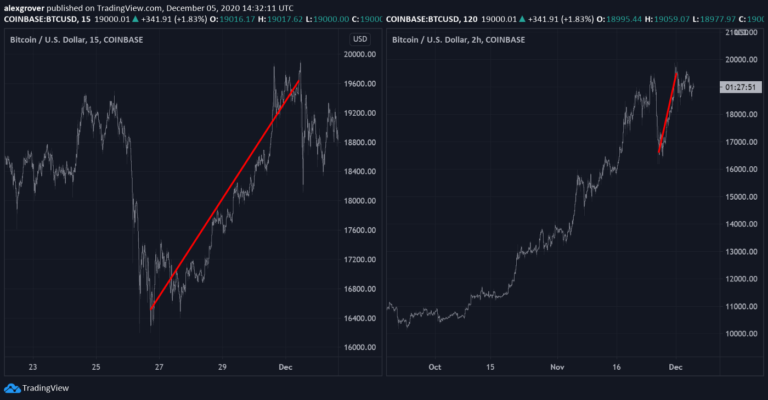

One of Deriv’s standout features is its extensive range of trading instruments. From traditional forex and commodity pairs to the more niche synthetic indices, the platform offers options that appeal to traders with varying strategies. Synthetic indices are especially intriguing, as they simulate market conditions but are unaffected by real-world events. This can be an exciting opportunity for traders who prefer predictable volatility without the influence of external news events.

Deriv offers multiple trading platforms:

- DTrader: A user-friendly, web-based platform perfect for traders who want simplicity. It has an intuitive interface with customizable charts and trading tools.

- DBot: This platform allows users to create their own automated trading bots without needing to code, which is a huge plus for those looking to automate their strategies.

- DMT5 (MetaTrader 5): This is the platform for advanced traders who need powerful charting tools, technical indicators, and access to CFDs. It’s ideal for those who like to engage in more sophisticated trading strategies.

For traders seeking to practice or test strategies, Deriv offers a demo account that mimics real trading conditions, which is excellent for building confidence without the risk of losing money.

User Interface and Experience

From a user experience standpoint, Deriv scores highly for its clean and intuitive interface. Whether you’re using DTrader or DMT5, the layout is designed to be accessible, even for those who are new to trading. Navigation is smooth, and executing trades is quick and straightforward. The learning curve is not steep, which is a breath of fresh air in comparison to some platforms that bombard new users with too much complexity from the get-go.

Customization is another strong point for Deriv. Users can tailor charts, add technical indicators, and set preferences for different trading instruments. This flexibility helps traders personalize their experience based on their strategies and needs.

Benefits of Trading with Deriv

- Wide Variety of Assets: As mentioned, Deriv offers a broad range of instruments, giving traders plenty of options to diversify their portfolios.

- Synthetic Indices: One of the unique selling points of Deriv is its synthetic indices, which are available 24/7 and are not influenced by real-world events. For traders who dislike being at the mercy of market news, these indices can provide a steady environment to trade.

- Low Minimum Deposits: Starting with Deriv doesn’t require a massive investment, which is great for beginners or those testing new strategies with smaller amounts.

- Automation with DBot: The ability to create automated bots without programming knowledge is a significant advantage for traders who want to set and forget their trades.

- No Commission Fees on Most Trades: Deriv doesn’t charge commissions on most trades, making it a cost-effective platform for frequent traders.

Notable Drawbacks

- Limited Asset Availability in Some Regions: Depending on your location, you might find that certain asset classes are restricted. This limitation could frustrate traders who want access to all available markets.

- Educational Resources: While Deriv does offer some basic resources, it falls short when compared to competitors who provide extensive educational content, webinars, and in-depth guides for beginner and intermediate traders.

- Withdrawal Process: Some users have reported delays in withdrawing funds, particularly when using certain payment methods. This could be a deterrent for traders who prioritize fast access to their earnings.

- Customer Support: While the platform offers live chat and email support, Deriv lacks 24/7 phone support, which might be a dealbreaker for traders who expect immediate assistance, especially during critical trading moments.

Personal Experience

In my experience using Deriv, I found the platform to be highly responsive and easy to navigate. Setting up trades was smooth, and I particularly enjoyed the flexibility of customizing charts and tools in DTrader. The synthetic indices intrigued me, providing a unique trading opportunity that I don’t often find on other platforms. However, I did experience some delays with customer support, especially during peak trading hours. The withdrawal process also took slightly longer than expected, but overall, the platform performed well in terms of trade execution and charting features.

Final Thoughts: Is Deriv Right for You?

Deriv Exchange offers an impressive variety of trading instruments and platforms, making it a good choice for traders of all experience levels. Its user-friendly interface, low minimum deposits, and innovative synthetic indices are all big advantages. However, it’s not without its drawbacks. Limited asset availability in certain regions, a lack of robust educational resources, and occasional delays in withdrawals may be areas of concern for some users.

Overall, if you’re looking for a flexible, low-cost platform with unique trading options like synthetic indices, Deriv is worth considering. Just be prepared to navigate the occasional hiccup in support and withdrawals.