Quan điểm của chúng tôi về JustMarkets

Được thành lập vào năm 2012 và có trụ sở chính tại Limassol, Síp, JustMarkets là một công ty môi giới phái sinh toàn cầu cung cấp hơn 260 công cụ giao dịch, bao gồm CFD trên các cặp tiền tệ, hàng hóa, cổ phiếu, chỉ số và tiền điện tử.

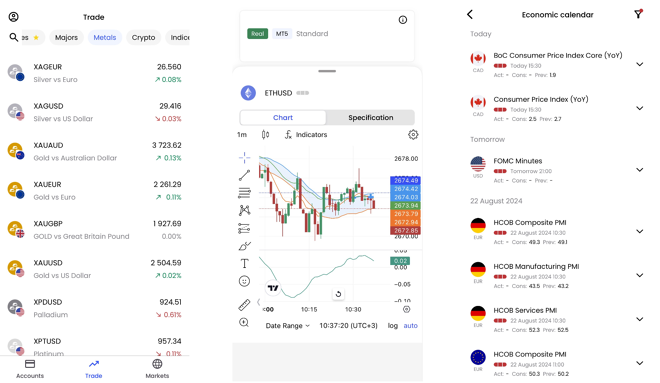

JustMarkets hỗ trợ cả MetaTrader 4 và MetaTrader 5 và cung cấp nhiều loại tài khoản với mức tiền gửi tối thiểu thấp và mức phí phải chăng cho các CFD cổ phiếu, cặp tiền tệ ngoại hối và hàng hóa phổ biến.

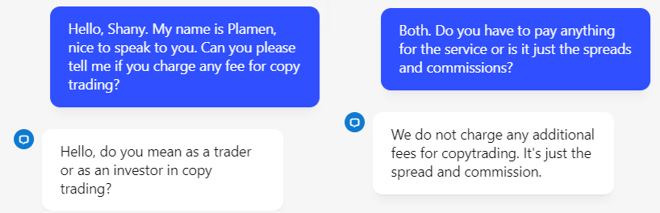

Tôi thấy JustMarkets là lựa chọn tuyệt vời cho những ai quan tâm đến giao dịch sao chép, vì sàn giao dịch này không tính thêm phí cho dịch vụ này. Ngoài ra, JustMarkets cung cấp tốc độ thực hiện lệnh nhanh, lý tưởng cho giao dịch có độ chính xác cao.

Tuy nhiên, nội dung nghiên cứu và giáo dục của JustMarkets có phần hạn chế và sàn giao dịch này thiếu nhiều nền tảng giao dịch.

| Được đề xuất trong 5 hướng dẫn môi giới tốt nhất: |

| Phí qua đêm thấp | MT4 | Giao dịch xã hội | Ứng dụng giao dịch | Tài khoản Hồi giáo |

Ưu và nhược điểm của JustMarkets

|

|

JustMarkets có phù hợp với bạn không?

Khi đánh giá một nhà môi giới, chúng tôi đánh giá xem liệu nó có phù hợp với các chiến lược giao dịch khác nhau hay không. Để đạt được điều này, chúng tôi đánh giá tính khả dụng của các tính năng và công cụ cần thiết. Sau đây là phán quyết của chúng tôi về JustMarkets:

Giao dịch ngẫu nhiên: Sự kết hợp hoàn hảo

JustMarkets là lựa chọn tuyệt vời cho các nhà giao dịch thông thường vì nó có yêu cầu ký quỹ thấp, phí cạnh tranh và nền tảng hỗ trợ thực hiện lệnh dễ dàng. Nhà môi giới này cũng đạt được tốc độ thực hiện lệnh nhanh và cung cấp phân tích thị trường hàng ngày có nhiều thông tin.

Giao dịch xã hội và sao chép: Sự kết hợp hoàn hảo

Giao dịch sao chép có sẵn trên MT4. Nhà môi giới cho phép các nhà cung cấp tín hiệu và người theo dõi tín hiệu tương tác với nhau. JustMarkets không tính phí dịch vụ cho giao dịch sao chép.

Giao dịch Swing: Không được khuyến khích

Phí qua đêm mà tôi ghi nhận với JustMarkets khá cao. Hơn nữa, sàn giao dịch này không kết hợp bất kỳ nội dung nghiên cứu của bên thứ ba nào (ví dụ: Autochartist hoặc Trading Central) để tạo sự tinh tế. Cuối cùng, JustMarkets không cung cấp bất kỳ chứng khoán nào có rủi ro thấp hơn, chẳng hạn như ETF hoặc trái phiếu, thường được sử dụng để quản lý những thay đổi về tính biến động trong trung và dài hạn.

Giao dịch trong ngày: Lựa chọn chấp nhận được

JustMarkets kết hợp MT4 và MT5, là những lựa chọn tốt cho các nhà giao dịch trong ngày vì chúng hỗ trợ phân tích kỹ thuật cơ bản và thực hiện lệnh dễ dàng. Nhà môi giới này cũng cung cấp phí giao dịch cạnh tranh cho một số công cụ phổ biến trên tài khoản Pro và Raw. Tuy nhiên, JustMarkets không có lựa chọn thay thế cho MetaTrader.

Scalping: Lựa chọn chấp nhận được

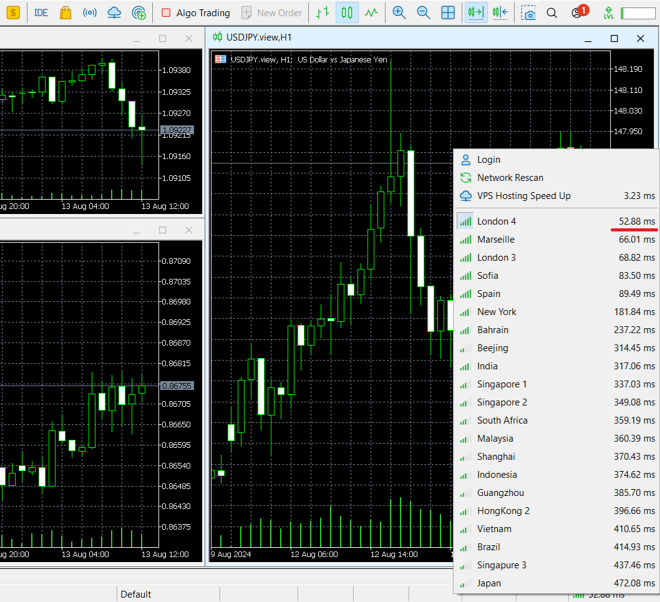

Tôi ghi nhận tốc độ thực hiện trung bình của JustMarkets vào khoảng 52 mili giây, tốt hơn mức trung bình của ngành. Hơn nữa, MetaTrader hỗ trợ giao dịch một cú nhấp chuột. Sẽ là một lợi thế lớn nếu nhà môi giới thêm dịch vụ lưu trữ Máy chủ riêng ảo (VPS) miễn phí để giao dịch có độ trễ thấp.

Tin tức giao dịch: Lựa chọn chấp nhận được

JustMarkets hợp tác với 7 nhà cung cấp thanh khoản, cung cấp thanh khoản sâu và thực hiện lệnh nhanh. Điều này rất quan trọng đối với giao dịch tin tức, nơi thanh khoản kém thường là rủi ro lớn nhất. Tuy nhiên, việc không có dịch vụ lưu trữ VPS miễn phí để kết nối ổn định là một nhược điểm.

Giao dịch tự động: Lựa chọn chấp nhận được

MT4 và MT5 hỗ trợ giao dịch tự động thông qua Expert Advisors (EA). Hai nền tảng này cũng có các công cụ kiểm tra chiến lược tích hợp để các nhà giao dịch có thể kiểm tra và tinh chỉnh các thông số của thuật toán giao dịch của họ. Tuy nhiên, việc thiếu dịch vụ lưu trữ VPS miễn phí đã ngăn JustMarkets đạt điểm cao hơn.

Đầu tư: Không khuyến khích

Nhà môi giới không cung cấp bất kỳ cổ phiếu thực nào.

Điều gì làm JustMarkets khác biệt?

JustMarkets không tính phí dịch vụ cho giao dịch sao chép, khiến đây trở thành một trong những lựa chọn hàng đầu cho loại hình giao dịch này. Chi phí duy nhất cho các nhà giao dịch sao chép là chênh lệch giá và có thể là hoa hồng dựa trên khối lượng, tùy thuộc vào loại tài khoản. Những chi phí này thường thấp hơn mức trung bình của ngành.

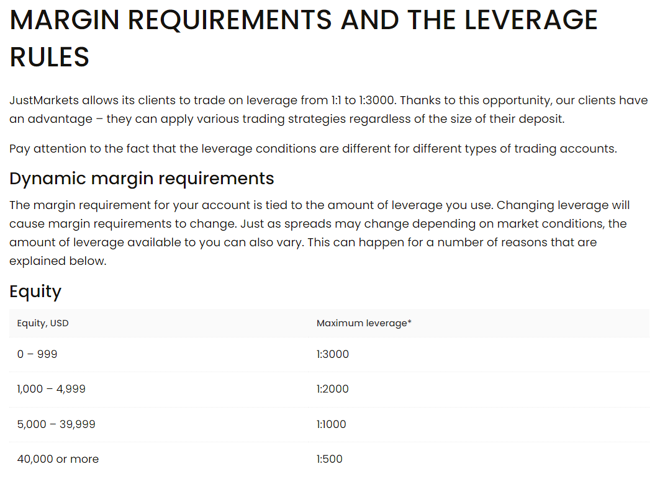

Nhà môi giới này cũng nổi bật với đòn bẩy bán lẻ tối đa là 1:3000. Nó có sẵn cho các tài khoản giao dịch có số dư dưới 1000 đô la.

Các tính năng chính của JustMarkets

| ☑️ Quy định | CySEC (Síp), FSCM (Mauritius), FSCA (Nam Phi), FSA (Seychelles) |

| 🗺 Ngôn ngữ được hỗ trợ |

Tiếng Anh, tiếng Indonesia, tiếng Bồ Đào Nha, tiếng Tây Ban Nha, tiếng Malaysia, tiếng Việt

|

| 💰 Sản phẩm | Tiền tệ, Cổ phiếu, Tiền điện tử, Chỉ số, Hàng hóa |

| 💵 Tiền gửi tối thiểu | 10 đô la |

| 💹 Đòn bẩy tối đa |

1:30 (CySEC), 1:3000 (FSCM), 1:3000 (FSCA), 1:3000 (FSA)

|

| 🖥 Loại bàn giao dịch | Không có bàn giao dịch, STP |

| 📊 Nền tảng giao dịch | MT5, MT4, Ứng dụng JustMarkets |

| 💳 Tùy chọn gửi tiền |

Chuyển khoản, Chuyển khoản nội địa, Tiền điện tử, Neteller, FasaPay, Skrill, Thẻ tín dụng, Boleto, PerfectMoney, SticPay, PayRetailers, Thẻ ghi nợ, Airtm, MoMo+3

|

| 💳 Tùy chọn rút tiền |

Chuyển khoản, Tiền gửi địa phương, Chuyển khoản địa phương, Tiền điện tử, Neteller, FasaPay, Skrill, Thẻ tín dụng, PerfectMoney, PayPal, SticPay, PayRetailers, Thẻ ghi nợ, Airtm+3

|

| 🤴 Tài khoản demo | Đúng |

| 🗓 Năm cơ sở | 2012 |

| 🌎 Trụ sở chính Quốc gia | đảo Síp |

Đánh giá đầy đủ về JustMarkets

Chúng tôi đã kiểm tra độ tin cậy của nhà môi giới như thế nào?

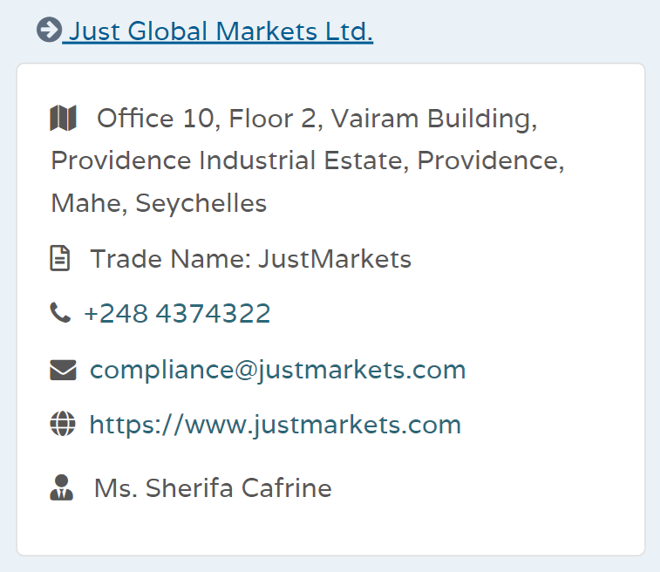

JustMarkets operates several entities that are regulated across the globe. The broker ensures the most essential safety mechanisms, such as the segregation of client funds and negative balance protection. As a whole, I rate JustMarkets as fairly transparent.

| Entity Features | Just Global Markets Ltd | JustMarkets Ltd | Just Global Markets (Pty) Ltd | Just Global Markets (MU) Limited |

| Country/Region | Seychelles, Mahe | Cyprus, Limassol | South Africa, Gauteng | Mauritius, Ebene |

| Regulation | FSA | CySEC | FSCA | FSC |

| Tier | 3 | 1 | 2 | 3 |

| Segregated Funds | Yes | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes | Yes |

| Compensation Scheme | No | Up to EUR 20,000 under ICF | No | No |

| Maximum Leverage | 1:3000 | 1:30 | 1:3000 | 1:3000 |

JustMarkets Regulations

In our reviews, we examine the licenses and regulations of each entity operated by a broker, allowing us to compare their different levels of protection. We rank licenses by various regulatory bodies on a three-tier system, where Tier-1 licensing indicates the highest level of regulation.

This is what I discovered about the four entities operating under the JustMarkets trade name:

- Just Global Markets Ltd is licensed and regulated by the Financial Services Authority (FSA) of the Seychelles under license number SD088. We rate the FSA as a Tier-3 regulator.

- JustMarkets Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 401/21. We rate CySEC as a Tier-1 regulator.

- Just Global Markets (Pty) Ltd is licensed and regulated by the Financial Services Conduct Authority (FSCA) of South Africa under license number 51114. We rate the FSCA as a Tier-2 regulator.

- Just Global Markets (MU) Limited is licensed and regulated by the Financial Conduct Authority (FCA) of Mauritius under license number GB22200881. We rate the FCA as a Tier-3 regulator.

Understanding the Regulatory Protections Associated with your Account

Brokers operate multiple entities to serve clients worldwide. However, licenses obtained from regulators in different jurisdictions do not always entail the same degree of protection.

Some regulators mandate compliance with the strictest financial frameworks, while others are less rigid. That is why traders must familiarize themselves with the safety mechanisms ensured by the entity they want to open an account.

Here is what you need to be looking for in a broker in terms of safety mechanisms:

- Segregation of client funds. Keeping client funds in segregated bank accounts from the ones used for the broker’s corporate capital negates the risk of accounting errors. All JustMarkets entities ensure the segregation of client funds.

- Negative balance protection. This safety mechanism removes the risk of trading losses exceeding the account balance. In other words, the losses you incur from trading are capped at the amount you have put in your trading account. Negative balance protection is available with all JustMarkets entities.

- Compensation scheme. A compensation scheme protects traders against the broker’s liabilities if the company becomes insolvent. The only JustMarkets entity that participates in a compensation scheme is JustMarkets Ltd. Its clients are protected against the broker’s liabilities by up to EUR 20,000 under the Investor Compensation Scheme (ICF).

- Maximum leverage. Capping the maximum leverage restricts the extent of market exposure to retail traders. The higher the leverage, the higher the potential profits and potential losses. The maximum retail leverage with JustMarkets is 1:3000.

Stability and Transparency

In our Trust category assessments, we evaluate factors tied to stability and transparency, including the broker’s longevity, company size, and information transparency.

I checked JustMarkets’ legal documents, particularly its Client Agreement. The information is extensive and readily available, and everything is written in an easy-to-grasp manner. Clients can read about all available safety mechanisms.

I appreciate that JustMarkets has taken the time to thoroughly explain its margin policy on its website. They specifically clarify that the maximum retail leverage is determined by the account’s equity, providing transparency and helping traders understand their leverage limits.

Is JustMarkets Safe to Trade With?

I concluded that JustMarkets is a safe broker to trade with due to the following factors:

- Authorized by one Tier-1 regulator

- Keeps client funds in segregated accounts

- Ensures negative balance protection

- Has transparent legal documents

Fees

How Did We Test the Broker’s Fees and Commissions?

JustMarkets’ trading fees on its Standard account vary between asset classes. More competitive fees are available with the Pro and Raw trading accounts. The broker does not charge a handling fee for deposits or withdrawals. However, an inactivity fee is applied after 150 days of no account activity.

JustMarkets Trading Fees

JustMarkets Spreads

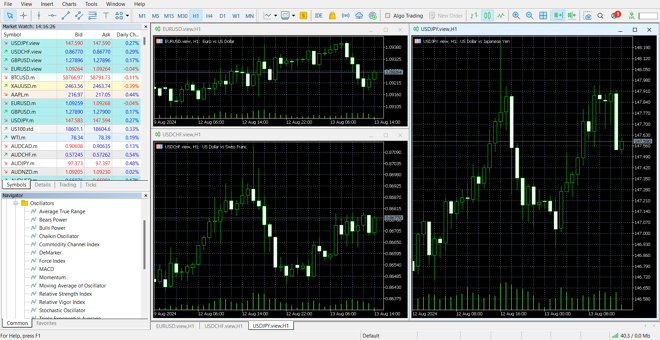

I tested JustMarkets’ spreads on 12 August 2024 during the London and the New York open. The results are shown in the table below:

| Instrument | Live Spread AM | Live Spread PM | Industry Average |

| EURUSD | 1.0 pips | 0.9 pips | 1.08 pips |

| GBPJPY | 2.1 pips | 2.9 pips | 2.44 pips |

| Gold (XAUUSD) | 18 pips | 29 pips | 42 pips |

| Crude Oil | 0.04 pips | 0.05 pips | 0.03 pips |

| Apple | NA | 0.17 points | 0.33 points |

| Tesla | NA | 0.25 points | 0.50 points |

| Dow Jones 30 | 6.9 basis points | 6.9 basis points | 3.3 basis points |

| Germany 40 | 4.2 basis points | 2.0 basis points | 2.4 basis points |

| Bitcoin | $24.76 | $25.43 | $35.5 |

Broken down by asset class and compared to the industry average, JustMarkets charges low spreads on share CFDs, low-to-average spreads on currency pairs and commodities, average spreads on cryptocurrencies, and high spreads on indices.

JustMarkets Swaps

A swap fee is a trader’s cost for holding an open position overnight because of changing interest rates. Swap long refers to the charge deductible or credit receivable for holding a buy position open overnight. In turn, swap short relates to the charges/credits deductible or receivable for holding a selling position open overnight.

The values listed below are for one full base currency contract (100,000 units).

| Instrument | Swap Long | Swap Short |

| EURUSD | Charge of $6.94 | $0 |

| GBPJPY | $0 | Charge of $37.02 |

My tests indicate that JustMarkets’ rollover charges at the time of the review were average-to-high compared to the benchmark. This is not particularly suitable for longer-term trading strategies, such as swing trading.

JustMarkets’ Non-Trading Fees

Deposits and withdrawals with JustMarkets are free. However, after 150 days of inactivity, the broker applies a $5 fee to dormant accounts.

Accounts Comparison

I have compiled the table below to help you better understand the difference between the trading fees of JustMarkets’ three retail account types and the industry average. It illustrates the spreads and commissions I have recorded for the EUR/USD pair and compares them against the typical costs for ECN and STP accounts in the industry at large.

The table demonstrates how much you would have to pay to trade 1 full lot (100,000 units) in EUR/USD with a pip value of $10 for each account.

To calculate the cost of such a full-sized trade, I used this formula: Spread x pip value+commission

| Account Type* | Minimum Deposit | Spread | Commission** | Net Cost |

| Standard | $10 | 1.0 pips | $0 | $10 |

| Pro | $100 | 0.8 pips | $0 | $8 |

| Raw Spread | $100 | 0.1 pips | $6 | $7 |

| Typical STP | NA | 1.2 pips | $0 | $12 |

| Typical ECN | NA | 0.2 pips | $6 | $8 |

*The numbers in this chart are only illustrative and subject to change over time

**Round-turn commission

According to my findings, the most competitive account with JustMarkets is the Raw Spread, which features a $6 round-turn commission per traded lot and raw spreads from 0.0 pips. This combination beats the industry average for both STP and ECN accounts. The Raw Spread account type is also quite accessible, given that its minimum deposit requirement is $100.

Are JustMarkets’ Fees Competitive?

JustMarkets’ fees are fairly competitive. Its spreads on the Standard account vary across instruments from different asset classes. I discovered that more competitive fees can be found on the Raw and Pro accounts. Another advantage of JustMarkets is that it does not charge any non-trading fees.

Platforms and Tools

JustMarkets incorporates the standard suites of MetaTrader 4 and MetaTrader 5. These platforms have straightforward designs and are suitable for most trading styles. Automated trading is possible via Expert Advisors (EAs). The broker achieves an average execution speed of around 52 milliseconds, beating the industry average.

| Platform/Tool | Suitable For |

| MetaTrader 4 | Basic technical analysis, simple order execution, automated trading |

| MetaTrader 5 | Basic technical analysis, simple order execution, automated trading |

| MT4 and MT5 mobile apps | Trading on the go |

| JustMarkets app | Trading on the go |

JustMarkets MT5 Desktop

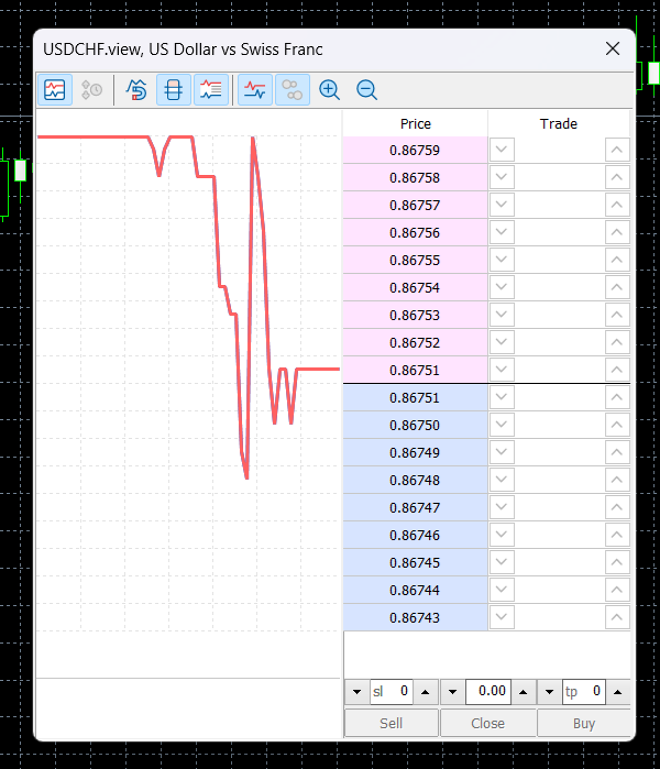

In this review, I tested the MetaTrader 5 platform, which features multiple essential tools, such as one-click trading, an alarm setting option, and a market depth tool. These allow traders to examine various market developments from different angles and to exploit the underlying trading opportunities in multiple ways.

MT5 is arguably best suited for automated trading via its Expert Advisors (EAs) feature. The platform also has an intuitive strategy tester, allowing experienced algo traders to tweak the parameters of their strategies so that they can be used under different market conditions.

Additionally, MetaTrader 5 has an intuitive mobile app, which helps traders stay connected to the global capital markets even on the go.

General Ease of Use

MT5’s layout is pretty straightforward. Account info is displayed at the bottom of the screen. Charts occupy the middle portion of the window; a watch list of selected instruments and tools screen is positioned on the left side of the window. A panel with various settings and configurations can be found at the top of the window.

Charts

I consider the charts screen a platform’s most important feature. It facilitates technical analysis by providing an overview of price action behavior. Chart artists use many analytical tools and chart configuration possibilities to examine it from multiple angles. In my experience, the really important aspect of a chart is how easy it is to scale price action up and down.

As shown above, the problem with MetaTrader is that the charts can be crowded quite easily, even when we add no more than 2 indicators. This obscures price action behavior and makes it more difficult to conduct probing technical analysis.

I have broken down the available analytical tools and chart configurations below:

- 38 technical indicators. The platform supports trend-based, volume-based indicators, oscillators, and more. These can be applied to study price action behavior and determine the underlying market sentiment. In general, technical indicators are used to gauge where the market is likely to head next.

- 24 drawing tools. Drawing tools, such as Fibonacci retracement levels and Elliott waves, are used to study repeatable price patterns. Additionally, they can be applied to determine key support and resistance levels and potential breakout or breakdown levels. Despite the rather large collection of drawing tools, MT5’s ruggedness makes it difficult to discern price action behavior.

- 21 timeframes. One of the standout features of MetaTrader 5 is its vast array of timeframes. MT5 allows multi-timeframe analysis of price action behavior. The greater the number of timeframes, the more intricate examinations that can be carried out across the short-term and long-term.

- 3 chart types. Price action can be represented as a line, bars, or candlesticks. This diversity allows traders to examine potential trading opportunities from different angles.

Orders

MetaTrader 5 features three types of order execution: market, pending, and one-click trading. One-click trading allows immediate entries at the spot price.

I have broken down the available order types on the MetaTrader 5 platform below:

- Market orders. Market orders are used for immediate entry at the best possible price. If triggered, they guarantee volume filling, though there could be a discrepancy between the requested price and the price where the order gets filled.

- Limit orders. Unlike market orders, limit orders guarantee exact price execution. However, a limit order will not be filled if the price action does not reach the pre-determined execution price.

- Stop orders. They are used to support open positions by limiting the maximum loss that can be incurred if the market turns in the opposite direction. A stop-loss order is placed at a fixed price below or above the spot price. If the market does indeed turn and triggers the stop-loss, it will transform into a market order and get filled at the best possible price.

MetaTrader 5: My Key Takeaways

In my opinion, MT5 is a good option for fast and simple order execution. On the other hand, its dated and rugged design falls short compared to newer, sleeker platforms. As a trader who prioritizes flexible chart scaling, I find MT5’s charting capability too rigid and less effective.

JustMarkets’ Execution Model

Just Markets operates as a Straight-Through-Processing (STP) broker without a dealing desk. Client orders are routed to the broker’s pool of liquidity providers, where they are filled.

I measured JustMarkets’ average execution speed over several days and assessed that the broker achieves speeds of around 52 milliseconds. This is faster than the industry average of 60 milliseconds. JustMarkets’ execution performance is suitable for implementing most trading strategy types.

JustMarkets’ Mobile App

JustMarkets developed its own feature-rich trading app, which has an intuitive design and charts powered by the seamless TradingView. The app features more than 50 drawing tools, 100 technical indicators, 9 timeframes, and 12 chart types. I was impressed by such diversity as it allows traders to study price action behavior from multiple angles. The app also supports all basic order types (market, limit, stop) and is an indispensable tool for trading on the go.

JustMarkets App: My Key Takeaways

JustMarkets app boasts an outstanding number of analytical tools and a user-friendly interface. However, it still suffers from the same underlying problem inherent to all trading apps. Analyzing price action behavior on low-resolution devices is extremely difficult. That is why I recommend using the mobile app only to monitor the development of your open positions and make changes if needed.

Tradable Instruments

How Did We Test the Broker’s Trading Platforms?

JustMarkets offers more than 260 tradable instruments across currency pairs, commodities, share CFDs, indices, and cryptocurrencies. This diversity allows traders to diversify their market exposure, though the broker does not offer any lower-risk securities, such as ETFs and bonds.

| Markets | Number | Types | Industry Average |

| Forex Pairs | 61 | Majors, Minors, Exotic | 30 – 75 |

| Commodities | 10 | Metals and Energies | 5 – 10 |

| Share CFDs | 163 | Retail, Tech, Financial, Other | 100 – 500 |

| Indices | 13 | Europe, US, UK, Asia | 5 – 10 |

| Cryptocurrencies | 17 | Major and Minor | 10 – 20 |

Compared to the industry average, JustMarkets offers an average number of currency pairs, share CFDs, and cryptocurrencies and a high number of commodities and indices.

What Are CFDs?

Contracts for difference (CFDs) are derivatives that speculate on the underlying asset’s price without physical ownership.

For example, a long position on gold would generate profit as the price rises or incur a loss as it falls, all without the need to purchase actual gold bars.

One of the biggest advantages of trading CFDs is that traders can get in and out of the market almost instantaneously, thereby catching even minute changes in the price of the derivative.

What Can You Trade With JustMarkets?

| Currency Pairs | Commodities |

| EURUSD | GBPJPY | USDCAD | NZDJPY | EURCHF | USDGBP | Gold | Silver | Crude Oil | Natural Gas | Palladium| Platinum | Brent Oil |

| Share CFDs | Indices |

| Apple | Tesla | Microsoft | Mercedes | Yelp | Alphabet | Netflix | Nike | Citigroup | Dow Jones 30 | Germany 40 | Nasdaq 100 | Japan 225 | France 40 | S&P 500 |

| Cryptocurrencies |

| Bitcoin | Ethereum | Litecoin | Bitcoin Cash | Litecoin | Doge Coin | Ripple |

JustMarkets Instruments: My Key Takeaways

JustMarkets offers a decent amount of tradable instruments across the most popular asset classes. Day traders and swing traders thus have plenty of options to exploit a wide array of trading opportunities.

The only thing lacking are lower-risk securities, such as ETFs and bonds. The inclusion of these would allow traders to better manage adverse volatility and diversify their overall market exposure.

Customer Support

How Did We Test the Broker’s Customer Support?

JustMarkets provides multilingual customer support available 24/7. Traders can reach the broker via live chat, email, and over the phone. There is also a callback option. The agents are generally knowledgeable and respond very fast.

Customer Support Channels

| Live Chat | Phone | |

| 24/7 via live chat | support@justmarkets.com |

|

Customer Support Test

When we test a broker’s customer support, we evaluate the agent’s knowledge of their own website, how long it takes them to respond to questions, and how detailed their answers are.

I conducted my test on 13 August at around 10.58 a.m. CET via live chat. Before getting in touch with an agent, I had to navigate a chatbot. It would be better if users had the option to request to be connected to an agent right from the start.

At any rate, an agent connected almost instantaneously. I asked about JustMarkets’ copy trading policy and received a satisfactory answer promptly. The agent was knowledgeable and polite.

For more general queries, traders can refer to the Help Centre of the website.

| Available Languages |

| English, Indonesian, Malaysian, Spanish, Portuguese, Vietnamese |

Deposit and Withdrawal

How Did We Test the Broker’s Deposit and Withdrawal Process?

JustMarkets accepts payments via bank cards, e-wallets, local bank transfers, and crypto-wallets. The broker does not impose a handling fee for deposits or withdrawals, though third-party processing fees may apply. Processing times fall within the norm.

JustMarkets Deposit Methods

| Payment Method | Currency | Processing Time | Fee |

| Credit/Debit Card | EUR, USD | Within 30 minutes | $0 |

| Bank Wire | AED, GHS, OMR, TRY, AUD, HKD, PHP, TTD, BBD, HRK, PKR, UGX, BGN, HUF, PLN, USD, BHD, ILS, QAR, ZAR, CAD, JPY, RON, ZMW, CHF, KES, SAR, CZK, MWK, SEK, DKK, MXN, SGD, EUR, NOK,THB, GBP, NZD, TND | 1-6 business days | $0 |

| Skrill | EUR, USD | Within 5 minutes | $0 |

| Neteller | EUR, USD, GBP, ZAR, CNY, MYR, JPY, AED, AUD, BRL, CAD, CHF, COP, INR, KRW, MXN, NGN, SGD, TWD | Within 5 minutes | $0 |

| Perfect Money | EUR, USD | Within 5 minutes | $0 |

| Sticpay | EUR, USD, JPY, KRW, CNY, PHP, AED, AUD, CAD, CHF, CLP, GBP, HKD, IDR, INR, MXN, MYR, NZD, SGD, THB, VND | Within 5 minutes | $0 |

| Airtm | USD | Within 5 minutes | $0 |

| Cryptocurrencies | BTC, BCH, ETH, USDC, USDT, BUSD, BNB, DOGE, LTC, XRP | Within 30 minutes | $0 |

| Local Bank Transfers | MYR, IDR, THB, VND, PHP, NGN, ZAR, | Within 30 minutes | $0 |

| African Mobile Money | UGX, KES, RWF, GHS, XAF, TZS | Within 30 minutes | $0 |

| Pay Retailers | USD | Up to 1 business day | $0 |

| Boletol | BRL | Up to 1 business day | $0 |

| Mo Mo | VND | Within 30 minutes | $0 |

| Fasapay | USD, IDR | Within 30 minutes | $0 |

Just Markets Withdrawal Methods

| Payment Method | Currency | Processing Time | Fee |

| Credit/Debit Card | EUR, USD | Up to 2 hours | $0 |

| Bank Wire | AED, GHS, OMR, TRY, AUD, HKD, PHP, TTD, BBD, HRK, PKR, UGX, BGN, HUF, PLN, USD, BHD, ILS, QAR, ZAR, CAD, JPY, RON, ZMW, CHF, KES, SAR, CZK, MWK, SEK, DKK, MXN, SGD, EUR, NOK,THB, GBP, NZD, TND | 1-6 business days | $0 |

| Skrill | EUR, USD | Up to 2 hours | $0 |

| Neteller | EUR, USD, GBP, ZAR, CNY, MYR, JPY, AED, AUD, BRL, CAD, CHF, COP, INR, KRW, MXN, NGN, SGD, TWD | Up to 2 hours | $0 |

| Perfect Money | EUR, USD | Up to 2 hours | $0 |

| Sticpay | EUR, USD, JPY, KRW, CNY, PHP, AED, AUD, CAD, CHF, CLP, GBP, HKD, IDR, INR, MXN, MYR, NZD, SGD, THB, VND | Up to 2 hours | $0 |

| Airtm | USD | Up to 2 hours | $0 |

| Cryptocurrencies | BTC, BCH, ETH, USDC, USDT, BUSD, BNB, DOGE, LTC, XRP | Up to 3 hours | $0 |

| Local Bank Transfers | MYR, IDR, THB, VND, PHP, NGN, ZAR, | Up to 24 hours | $0 |

| African Mobile Money | UGX, KES, RWF, GHS, XAF, TZS | Up to 24 hours | $0 |

| Pay Retailers | USD | Up to 24 hours | $0 |

| Fasapay | USD, IDR | Up to 3 hours | $0 |

Account Types and Terms

How Did We Test the Broker’s Account Types and Terms?

JustMarkets offers three retail account types. The minimum deposit requirement is $10. Traders can choose between 13 base currencies. The broker also offers Multi-Account Management (MAM) accounts and a Standard Cent account on MT4. Swap-free trading is also available.

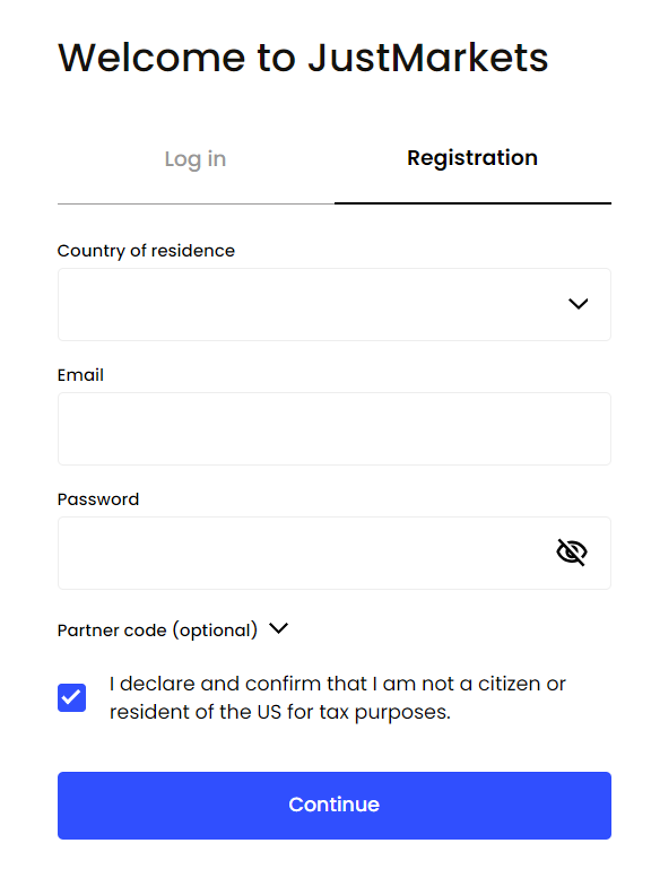

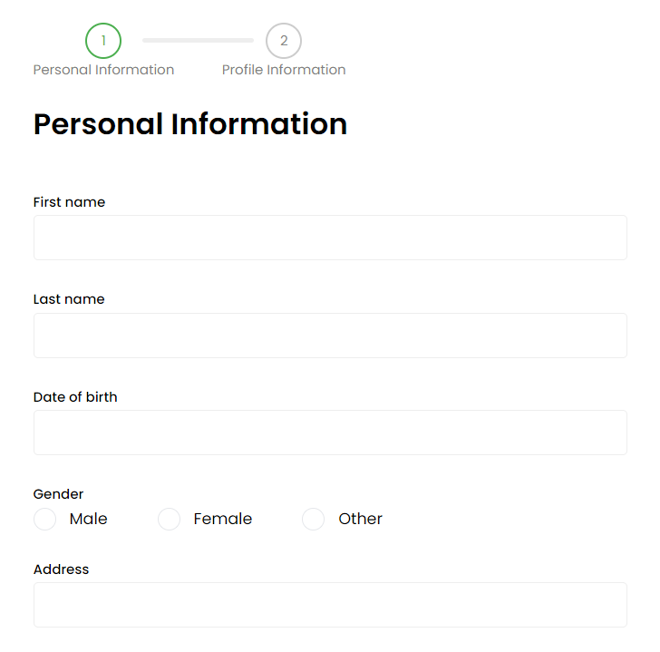

JustMarkets Account Opening Process

To open an account with JustMarkets, follow these easy steps:

- Click ‘Register’ at the top-right corner of the main page.

- State your country of residence and email address.

- Choose a password and declare that you are not a US resident for tax purposes.

- Confirm your email address.

- Enter the rest of your personal details.

- Upload proof of address and proof of ID to verify your account.

JustMarkets Accounts Types

| Account Type | Standard | Pro | Raw ECN |

| Spread From | 0.3 pips | 0.1 pips | 0.0 pips |

| Commission* | $0 | $0 | $6 |

| Minimum Deposit Requirement | $10 | $100 | $100 |

| Margin Call | 40% | 40% | 40% |

| Stop Out | 20% | 20% | 20% |

| Base Currencies | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN |

| Execution | Market | Market | Market |

| Islamic Account | Yes | Yes | Yes |

| Demo Account | Yes | Yes | Yes |

*Round-turn per one full contract

My research indicates that JustMarkets’ accounts are diverse and user-friendly. The broker offers a combination of low trading fees and low deposit requirements. Its margin call is set at 40% and the stop-out level at 20%. This combination protects traders against the risk of a complete account wipeout.

JustMarkets also impresses with its maximum retail leverage of 1:3000, which is available to accounts with a net equity of below $1000. Furthermore, traders have a wide array of available base currencies.

Demo Accounts

JustMarkets offers demo accounts that introduce traders to the broker’s services and allow them to tweak their strategies in a risk-free environment. The market is continually evolving and never static, so it is important to hone your skills in a safe environment. You can set up a demo account for yourself prior to or alongside your live CFD account.

Islamic (Swap-Free) Account

JustMarkets provides swap-free trading in compliance with Shariah law requirements. Traders seeking an Islamic (swap-free) account must request this service by contacting JustMarkets’ customer support.

What is CFD Leverage?

Leverage determines a trader’s overall market exposure. When trading Contracts for Difference (CFDs), positions can be opened for a fraction of their value because of leverage. Essentially, the broker lends the trader money so that they can open bigger positions. Leverage multiplies the profits a trader generates from winning positions but also the losses incurred from failed trades.

Risk Warning: CFDs are complex instruments, and due to leverage, they can be highly risky and cause rapid fund loss.

Maximum Leverage By Asset Class

In the table below, I have listed the maximum retail leverage available with JustMarkets for instruments from different asset classes:

| Asset Class | Maximum Leverage |

| Currency Pairs | 1:3000 |

| Metals | 1:3000 |

| Energies | 1:200 |

| Share CFDs | 1:20 |

| Indices | 1:500 |

JustMarkets Restricted Countries

Just Markets Global Limited does not provide services to residents and citizens of certain jurisdictions, including Australia, Canada, Japan, the United Kingdom, the United States of America, and countries sanctioned by the EU.

Research

JustMarkets offers a variety of research content developed in-house. It provides an intuitive economic calendar and publishes daily market breakdowns and forecasts. The content is very informative and easy to digest. However, the broker does not incorporate any third-party content.

Research Tools

I have broken down the available research content with JustMarkets below:

- Economic calendar. The economic calendar is critically important because it informs traders of upcoming economic releases, speeches, and other events that typically result in heightened market volatility and, therefore, viable trading opportunities.

- Market breakdowns. JustMarkets publishes daily marker breakdowns developed in-house. They cover recent market developments and utilize economic and fundamental market analysis.

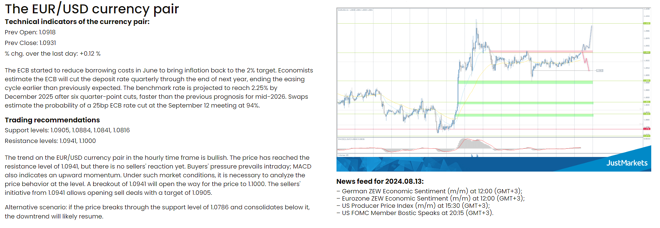

- Market forecasts. The broker also breaks down viable trading setups that are currently developing, using technical, fundamental, and economic analysis. Each article is supplemented with a chart. Traders can read about viable entry and exit levels, support and resistance levels, stop-loss levels, and more.

JustMarkets Research: My Key Takeaways

I found JustMarkets’ research content to be quite practical. The daily forecasts can be used by day traders to spot viable trading opportunities that are currently developing. The broker also used to have a news screener, but it has not been updated in several years.

My only gripe is that JustMarkets does not incorporate any third-party content, such as Trading Central or Autochartist, that could offer traders a different perspective.

Education

How Did We Test the Broker’s Education Offering?

JustMarkets offers hundreds of written articles and a handful of past webinars. The materials are fairly insightful and cover a broad range of trading topics. The broker also offers several video platform tutorials.

JustMarkets has published over 20 webinars on its website and YouTube channel. The webinars introduce beginners to a wide range of topics, such as how to use moving averages, read Fibonacci retracement levels, implement advanced scalping strategies, and more.

Most impressively, the broker has published over 300 written articles on its website. These have extremely diverse topics – from the meaning of various chart patterns to what nutrition is good for traders. There are also several videos explaining how to use MetaTrader 4 and MetaTrader 5.

The broker does not offer an educational e-book or any trading courses and has limited educational video content.

The Bottom Line

JustMarkets là một công ty môi giới ngoại hối và CFD được thành lập vào năm 2012 và có trụ sở chính tại Limassol, Síp. Công ty được cấp phép và quản lý tại nhiều khu vực pháp lý khác nhau và cung cấp cho khách hàng quyền truy cập vào hơn 260 công cụ có thể giao dịch trên nhiều loại tài sản khác nhau.

JustMarkets kết hợp các nền tảng MetaTrader 4 và MetaTrader 5 và tính phí giao dịch phải chăng. Đáng chú ý là không có phí dịch vụ cho giao dịch sao chép, khiến đây trở thành một trong những lựa chọn tốt nhất cho các nhà cung cấp tín hiệu và người theo dõi tín hiệu.

Nhà môi giới đạt được tốc độ thực hiện lệnh nhanh, mà tôi đo được là khoảng 52 mili giây – nhanh hơn đáng kể so với mức trung bình của ngành. Hiệu suất này rất phù hợp cho giao dịch có độ chính xác cao.

Mặt khác, nội dung giáo dục của JustMarkets thiếu tính đa dạng. Nhà môi giới này cũng không cung cấp bất kỳ nền tảng giao dịch thay thế nào.

Nhìn chung, tôi xác định rằng JustMarkets là lựa chọn tốt cho các nhà giao dịch thông thường vì nó có yêu cầu ký quỹ tối thiểu thấp và dịch vụ hỗ trợ khách hàng đáng tin cậy. Trong khi đó, các nhà giao dịch nâng cao có thể hưởng lợi từ phí giao dịch ưu đãi của nó.