Introduction to XM Broker

XM Broker is widely regarded as a reliable and user-friendly platform, catering to both beginner and professional traders. Established in 2009, XM has grown to serve more than 1.5 million clients across 196 countries. XM is recognized for its transparency, offering commission-free trading, swift execution times, and access to over 1,000 financial instruments. With features like auto trading, no hidden fees, and 99.35% of orders executed in under a second, XM stands out as a top choice for many in the forex and commodity trading markets.

Company Overview and Regulation

XM operates under XM Group, which includes several regulated entities:

- Trading Point of Financial Instruments Ltd: Founded in 2009 and regulated by CySEC (Cyprus Securities and Exchange Commission).

- Trading Point of Financial Instruments Pty Ltd: Launched in 2015 and regulated by ASIC (Australian Securities and Investments Commission).

- XM Global: Established in 2017 and regulated by the International Financial Services Commission (IFSC) of Belize.

- Trading Point MENA Limited: Operating since 2019, regulated by the Dubai Financial Services Authority (DFSA).

These regulatory bodies ensure that XM adheres to strict financial standards, making it a trusted broker for international traders.

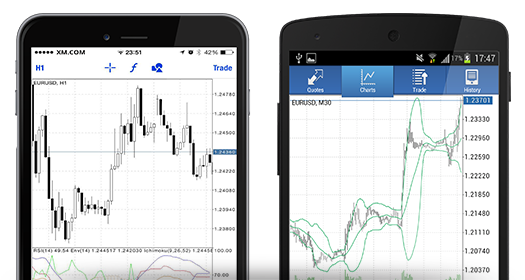

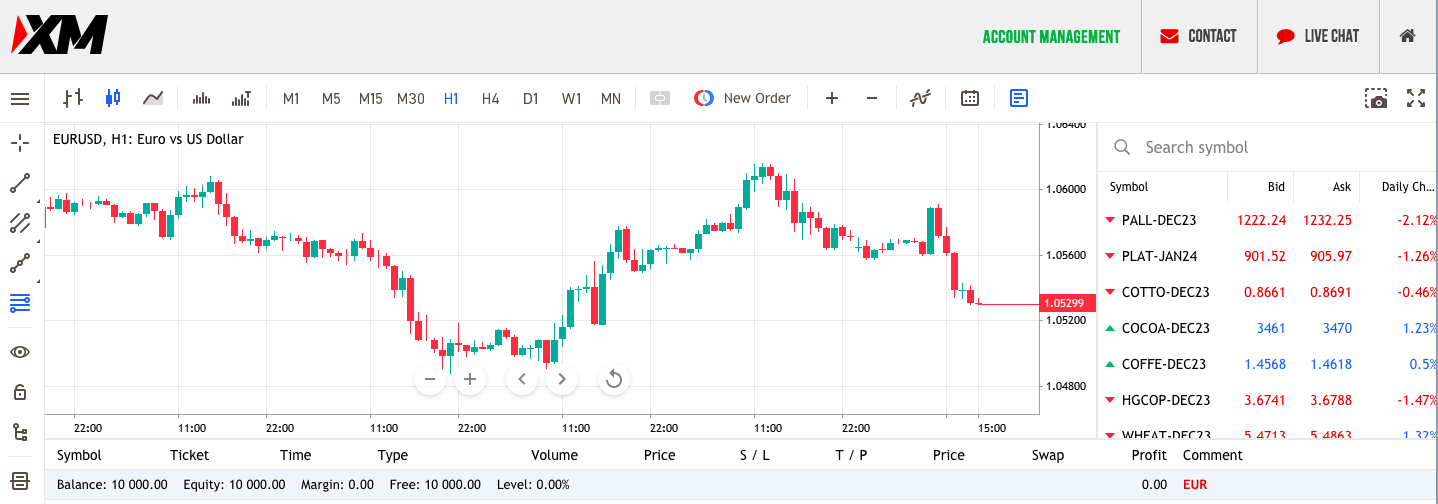

XM Trading Platforms

XM offers two primary platforms:

- MetaTrader 4 (MT4): A platform geared towards forex traders, offering various order types like stop, limit, market, and trailing orders. It’s equipped with robust charting tools and supports expert advisors for automated trading.

- MetaTrader 5 (MT5): This multi-asset platform provides access to a broader range of instruments beyond forex, such as stocks, indices, and commodities.

Both platforms are available on desktop and mobile devices, ensuring flexibility and convenience for traders who need to manage their portfolios on the go. XM’s mobile apps are compatible with Android and Apple devices and feature intuitive interfaces for seamless trading.

Assets and Markets

XM offers over 1,000 financial instruments for trading across various asset classes:

- Forex Trading: More than 55 currency pairs, including major, minor, and exotic pairs.

- Commodities: Trade CFDs on commodities like gold, silver, oil, and agricultural products.

- Indices: Access major global equity indices such as the S&P 500, FTSE 100, and Nikkei 225.

- Precious Metals: In addition to forex and indices, XM provides opportunities to trade CFDs on metals.

- Energy CFDs: Includes instruments like oil and natural gas.

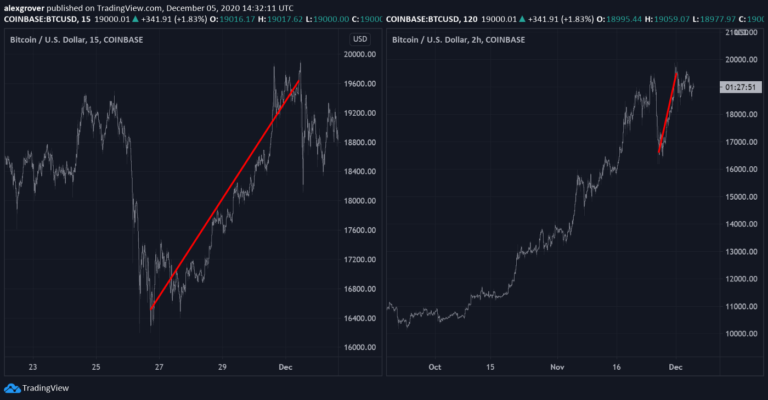

However, it’s worth noting that XM does not offer trading in cryptocurrencies or binary options, which might limit options for some traders.

Spreads and Commission

XM’s spreads and commission structure varies depending on the account type:

- Micro and Standard Accounts: Offer floating spreads starting from 0.1 pips with no additional commissions.

- Zero Accounts: Feature ultra-low spreads starting from 0.0 pips, but with a small commission on trades.

XM operates with a no-hidden-fee policy, covering transfer costs and ensuring commission-free withdrawals for most accounts. Withdrawals are processed within 24 hours, providing traders quick access to their funds.

Leverage

XM offers flexible leverage ranging from 2:1 to 30:1, depending on the asset and the regulatory jurisdiction. The leverage applies uniformly throughout the week, ensuring predictable margin requirements even during weekends.

Account Types at XM

XM offers four main types of accounts:

- Micro Account: Suitable for new traders, requiring a minimum deposit of just $5 and offering micro lots (1,000 units).

- Standard Account: Ideal for experienced traders, also with a minimum deposit of $5, but offering standard lots (100,000 units).

- Ultra-Low Account: Offers tighter spreads and is designed for traders looking for the lowest costs, with a minimum deposit of $5.

- Zero Account: Features raw spreads starting from 0.0 pips, available with a minimum deposit of $5, but with a commission per trade.

All account types come with the option of using multiple base currencies, including USD, EUR, GBP, and more, and are compatible with both MT4 and MT5 platforms.

Demo Account and Educational Resources

XM offers a comprehensive demo account, allowing users to trade with $100,000 in virtual funds under real-market conditions. The demo account is unlimited in time, making it an excellent tool for both novice traders and experienced professionals looking to test new strategies risk-free.

In addition to the demo account, XM provides a wide array of educational resources:

- Webinars: Regular webinars for traders of all experience levels, covering various topics from technical analysis to market strategies.

- Training Videos: Educational video tutorials aimed at teaching traders the basics of forex and CFD trading.

- Market Research: Detailed daily market analysis and reports to keep traders informed of key market trends and opportunities.

XM Customer Support and Security

XM is renowned for its excellent customer service. Support is available in multiple languages via live chat, email, and phone. While the support team is accessible 24/5, users seeking assistance on weekends may find limited availability.

The broker complies with stringent security measures, requiring verification through government-issued ID and proof of address for account registration. Furthermore, XM’s data protection practices are robust, safeguarding clients’ personal information.

Pros and Cons of XM

Pros:

- Regulated by multiple authorities: Ensuring client protection and fund security.

- User-friendly platforms: MT4 and MT5 available on desktop and mobile.

- Flexible account types: Suitable for both beginners and advanced traders.

- No hidden fees: Transparent fee structure with commission-free trading on most accounts.

- Excellent educational resources: Catering to traders of all experience levels.

Cons:

- No cryptocurrency trading: Limited to traditional assets like forex, commodities, and indices.

- Support is not 24/7: Customer service is available only during the trading week.

- Lack of account variety: Some traders may find limited differentiation between account types.

Conclusion

XM stands out as a well-rounded and reliable broker with a strong regulatory framework, excellent educational resources, and a range of account types designed to meet the needs of different traders. While it may lack some features, such as cryptocurrency trading, its competitive spreads, user-friendly platforms, and no-hidden-fee policy make it a top choice for many traders globally. Whether you’re new to trading or an experienced professional, XM offers the tools, resources, and flexibility to help you succeed in the financial markets.